With the high burnout and ever-decreasing reimbursement rates, more and more physicians are looking beyond their core clinical roles for their practice growth. Some of them become medical directors for Med Spas in the last few years for a monthly fee of $3,000 – $6,000 depending on the level of involvement. Amongst them, a small proportion even becomes the sole owner or co-owner of the Med Spa itself.

Most of those who made the plunge were inspired by the following “claims” from sources like https://www.americanspa.com/.

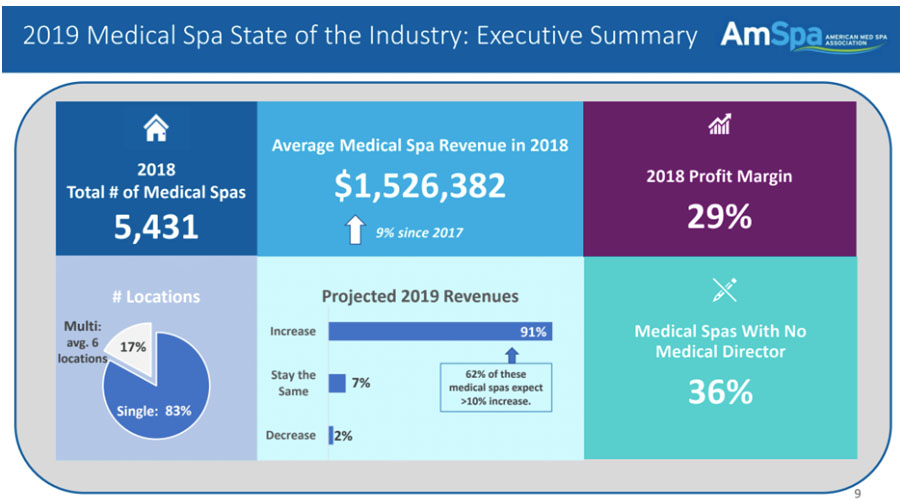

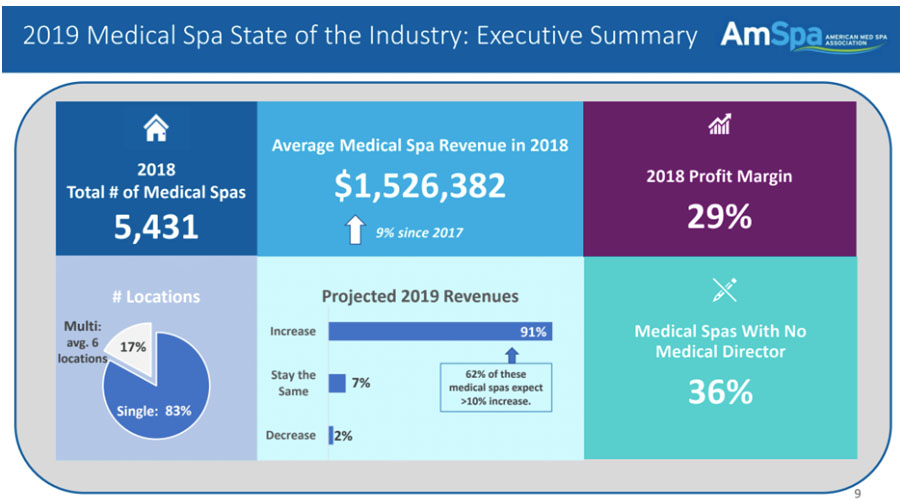

“The average medical spa brings in $1 million per year according to the AmSpa 2019 Medical Spa State of the Industry Report, and top practices can approach $4–$5 million.”

“Data estimates that revenues of medical spas in 2012 were $1.94 billion and will hit $3.6 billion in 2016. The market is forecast to grow 18% per year.”

“… even during the COVID19 period, many of the Med Spa still flourished…”

Unfortunately, from the cases observed on the ground, especially after the COVID19 pandemic, we found a lot of “caveats” that would have rendered the above rosy outlook extremely misleading. So, we give the 10 most popular “myths” well-publicized, a reality check. It serves as “gut checking” for these before making the commitment to owning a Med Spa. For those who might be feeling the headwind, use this list to start planning some mitigation actions. (Feel free to click on each myth to expand on the one(s) to learn the “reality”.

Myth 1: “It is easy to recover the investment on MedSpa as it is a super lucrative business.”

Reality: Read More

Start-up costs for medical spas are

between $700,000 and $1,000,000. If a physician is going to open a medical spa, they have to approach it as a small business venture and be committed to staying with it for a minimum of 3 years before they see many financial returns

https://www.nonclinicalcareers.com/physicians-starting-running-medical-spas/

For most of the clients, we worked with in this field, the startup cost for an operation to make over $1,000,000 in revenue per year, the startup cost before one opens the door is already well above $1,000,000 for the location renovation, deposit for a premium location, initial product ordering (e.g., the injectables are not cheap). Even when many product vendors extend 30-90 days of credit, many others have fallen on a hard time too and started on demanding cash payments for their products.

The carrying cost of $1,000,000 over three years, using the average rate of return from the market, are close to $250,000. Many of the physician owners are putting their sweat equity in, i.e., they are not taking their salary or drastically reducing their salary from the fledgling practice, depending on their original specialty (e.g., primary physicians $250,000, to dermatologists of $500,000+), there is the additional opportunity cost of over $1,000,000 if not more.

3 years is a reasonable time horizon but that is only to see the meaningful positive cash flow and it will take another 3 years to cover the real startup cost of $2,000,000 for the first three years.

(The above figures may not apply to Aesthetic certificated practitioners, without MD licenses, who might be running a one-person unicorn show in a “room inside a clinic” arrangement)

Myth 2: “Med Spa is printing money”. The profit margin should be around 40-50 percent.

Reality: Read More

Most Med spas’ bookings are running below 50 percent capacity (many new facilities even half this rate during the first few months of operation), leading to minimal or no profits.

Despite the high price tag for the Med Spa services from simple injectables to body contouring machines such as Coolsculpting or Emsculpt (one of these treatments can run you thousands of dollars per session/package), most of the spas providing these high price services usually come with high operating expenses including payroll(The average annual salary expectation for an injector, especially legal, is over $120K), inventory (the profit margin on legitimate Botox can be as low as 20-30% after discounts), and equipment monthly lease & insurance payment (It is not uncommon to have $5K for one piece of equipment like Emsculpt every month)

The 40-50 percent profit margin might be applicable for those Med Spas that already got the majority of their overheads covered when it is adjunct with a dermatologist or plastic surgeon’s practices. For the stand-alone Med Spas, an acceptable profit margin is 10 to 15 percent…the margin is too thin to be comfortable in a highly competitive and fluid market like Med Spa. There are so many facets involved in running a medspa, even the seemingly smallest of the errors could put one in red in the blink of an eye.

Myth 3: “Once you survive the first few years, your profit margin will keep improving as you will have loyal customers.”

Reality:Read More

A significant percent of Med Spa customers are deal seekers. These are the ones who will switch if your competitor’s Botox is $1/unit cheaper than yours. So, any Med Spa aiming to grow, even keep at the same scale, has to keep investing in marketing to maintain/grow their brand in customers’ mind share.

Successful Med Spa keeps consistent pressure on marketing. It is not uncommon to see 20% of revenue, even for mature Med Spas, be channeled into Google Adwords Campaigns, social media ad campaigns (mostly in IG), content marketing, and events, in addition to email & text marketing campaigns to their existing customer base. Using your mailing list, communicate with your clients by sending out postcards informing them of upcoming promotions and events. In addition to the marketing budget, one has to invest in in-house sales resources to do the follow-up and close the deal. Even though some of the practices may be reducing the marketing budget, the sales cost is usually will maintain at a fixed % of the revenue as the internal sales have a high variable tied to the size of the sales.

Myth 4: “We need to maximize the number of services offered to maximize our revenue.”

Reality:Read More

It is very costly to be everything to everybody. More services usually mean more treatment rooms, more aestheticians, and more equipment, requiring bigger investment to support. The number of service offerings has a close correlation with the operation complexity, especially in terms of coordination, which can drastically impact the ROI.

Myth 5: “To acquire new customers, we need to locate in the high foot traffic area, e.g., a mall.”

Reality:Read More

The rent for the high traffic areas carries its premium. With a 10-15% profit margin, Med Spa has to contain rent, one of its biggest overhead items, to be under 15% of its total revenue. Med Spa, especially those collocated with a doctor’s practice is considered a destination themselves: patient will travel to see a doctor, hence, the Med Spa. We have seen plenty of successful Med Spas operating out of the “back alleys” as they have achieved a balance with their targeted segments, product/service niche, synergy with other offerings in the vicinity,

Myth 6: “Med Spa is a simple business as it is a “cash” business”.

Reality:Read More

Med Spa, due to the “Med” in its name, has significant compliance requirements from OSHA, laser equipment registration, aesthetician training, and certifications in addition to treatment forms, and procedure documentation. In recent years, many medical boards such as TMB (Texas Medical Board), releases tightening guidelines on who is qualified to perform certain procedures such as injection(TMB newsletter in May 2019). The cost of not having these policies and procedures in place includes staff stealing, customer complaints, and even the FBI knocking on your door as what happened to the Houston Medspa in the Spring of 2019. The cost of being compliant is significant and almost always under-estimated.

Myth 7: “It is better to employ staff that can support both the medical clinical and Med Sap to save labor cost”.

Reality:Read More

One of the key benefits of Med Spa collocating with a derm or plastic surgery practice is that the MAs, Aestheticians, and front desk staff are expected to be crossed trained and support both sides, which can increase the labor efficiency to handle different peaks of operation. However, merging a medical spa with the medical side is actually much more challenging mostly due to the fact that the service mentality for these two separate lines is different, to start with, the expectation on patient service level varies greatly between the Med Spa staff and the insurance supported medical side. Also, the difference in compensation package can also discord between the sets of staff(Med Spa staff usually has commission while medical side does not). It is not easy to keep a harmonious and productive collaboration between two sets of staff.

Myth 8: “The labor cost for a Med Spa is not high as the estheticians need minimal certification and training vs. years of training for MD, NP and other clinical staff including the billers”.

Reality:Read More

It is true that some junior estheticians only expect less than $30,000 a year due to the relatively low threshold of entry. However, as it usually takes years for an aesthetician to develop a “following”, a new practice usually will need to recruit one or two veteran aestheticians who had already amassed a “fan base” to draw them into the new facility. While many of these “veteran” estheticians do pull in sizable business, their expected compensation matches. Between the squeeze of competitive pricing and the “highly compensated” staff, sometimes, the higher revenue does not translate into higher profit for the Med Spa owner(s). To make things worse, in a high turnover industry, the Owners, in many incidences, have to crouch down to these “high value” estheticians’ demands as they usually OWN “their customer followings”: if they leave the practice, the revenue from their “followings” will leave with them too. No matter how well the owners try to keep the customer data in the facility’s database, the “followings” allegiance mostly stays with the individual esthetician, who had nurtured the loyalty with their great customer service skills, and “freebies”, usually at the expense of various Med Spa owners’. In summary, talent management for Med Spa, except for those one-person shows (the owner is the main contributor of revenue) is one of the top 3 levers for the operation result of a Med Spa.

Myth 9: “The demand for Medical Aesthetic services will continue to grow with the aging population in pursuit of ‘aging gracefully”.

Reality: Read More

But will they?

Before COVID-19 pandemic, a 2017 report from American Med Spa Association (AmSpa), using data from its survey of 500 US-based medical spas, indicated that there were 4,200 medical spas in the USA, generating $3.7 billion in revenue.

The global medical spa market was valued at $11 billion in 2017 and is expected to reach $27,566 million by 2025 at a CAGR of 12.2% during the forecast period.

However, the world of medical aesthetics has been turned upside down with many fundamental changes in the underlying growth assumptions, some of them are permanent, e.g.

- Multiple rounds of the “Shelter in place” policy have discouraged many customers of med spa services to come into the clinic for their services, at least reducing the frequency. It is not common to see the volume drop by 50% as many customers, after weighing the risk of “getting COVID” and “looking good(while not in a social setting), chose to skip appointments or seek home-based treatment such as LED masks.

- With the increasing popularity of the Metaverse concept, more and more activities will be moved to virtual mode. It is not an inconceivable idea that people may put less emphasis on their own physical appearance as we may be using “virtual identity” e.g., avatars in our social and professional interactions.

Myth 10: “If you invest into the latest laser machines, you will acquire new customers and revenue streams for your facility. Usually, you will get it paid off within 18 months. With easy equipment financing, you will be making money from Day 1. After the equipment is paid off, you will be making a ton of profit as you do not have the hefty monthly payment anymore.”

Reality: Read More

Although medical aesthetic equipment vendors e.g., Allergan, Candela, Lumenis offer very attractive purchasing terms to make it easy for you to sign above the dotted line, such as“$99/month for the first 3 months” or “no payment for the first 6 months if you are an MD”, the total payments with the financing rate can be close to 20% per year with prepayment penalties. For some of the popular treatments, the vendor sales, motivated by sales commission, may saturate your local market so you have to resort to pricing war to pay the hefty monthly equipment lease. It is uncommon for such equipment decisions to be settled/resold with 50%+ loss. For the luckier ones, it usually takes way more than 18 months to recover the total purchasing cost.

Also, over half of the Esthetics machines have hefty consumables. Similar to the printer and ink business model, many of the equipment manufacturers are selling their machines at a cost but developed a simple mechanism in their machine that ties variable costs in the forms of consumables, batteries, or simply counter for counter’s sake. We are not talking about small numbers, these are battery packs costing more than 5 digits (covering a certain number of cycles so each cycle will cost $50 or simply $300 per cycle that may account for half of the treatment revenue, e.g., Coolsculpting card).

There is a saying, “The lion’s share of the Medical aesthetics is taken away by the laser equipment vendors.”

There are some solution providers to address this barrier by “timeshare” the more popular but expensive equipment. Some of the practices are able to avoid the upfront capital investment while gripping the benefits by doing extremely short “leasing”, e.g. daily, of the equipment. Check out an example of such service here.

Conclusion and what you can do now

Read More

In summary, the operating environment for Medical Aesthetics has changed significantly post the Pandemic. The “10 Myths busted” referred to above, observed from our first-hand client services projects and research, are meant to remind any medical providers or potential investors who are attracted by the industry’s perks/glamor and attractive cash profit to assess one’s operating plan in this industry with new headwinds.

For those who are passionate about the medical aesthetic industry, whether in business already or planning to get into this industry, we strongly recommend that they get an objective, third-party assessment of its operation and competitive environment either for peace of mind or, potentially, save you years of headache and financial loss.

If you would like to have a chat about your practice, please fill out this form so we can make our meeting more effective with some quick research prior to the meeting.