Why do most ACOs fail and

what to do about it

Why do almost half of American Accountable Care Organizations (ACOs) fail? Although the intention behind ACOs to provide better care for Medicare beneficiaries while reducing costs to the government seems like a worthy venture, changes to Centers for Medicaid and Medicare Service (CMS) reimbursement structure can be difficult from some organizations. What is an ACO to do to get one the success half?

First of all, let’s agree on the parameters to gauge ACO Success:

- Patient Experience

- Meeting the cost saving targets

- Meeting Quality Metrics: We will elaborate on this point more as without meeting these metrics, the first two are “Not Applicable” for any “Shared Saving Payments” from payers.

Providers and payers continue adopting a patient-centric approach to Medicare patients’ healthcare in alignment with Center for Medicare and Medicaid’s (CMS) 33 quality standards and other industry benchmarks. More and more Affordable Care Organizations (ACOs) (Medicare program supported networks) also selected their own benchmarks, not dissimilar to the CMS ’33 quality measures, aiming at demonstrating the improved outcome based on optimized procedures and protocols.

However, many still question whether or not the standards are a true measurement of what makes an ACO effective at improving patient-care. For example, in 2015 Dartmouth-Hitchcock, Steward Health Care System, and Mount Auburn Hospital joined other former Pioneer ACOs citing issues with the model’s, “risk-adjustment methodology, target benchmarking, and incentive distribution …” CEO Dr. James Weinstein of Dartmouth announced one reason for withdrawal from the Pioneer track was that the ACO owed $3.6 million at the end of 2014.

Source: S. Lawrence Kocot, Ross White, Pratyusha Katikaneni and Mark B. McClellan. A More Complete Picture of Pioneer ACO Results. Brookings. 13 October 2014. Web. Accessed May 2016.

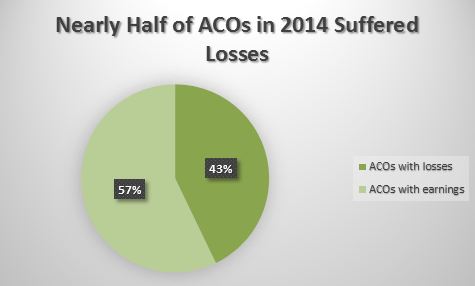

With 43% of Pioneer ACOs in 2014 posting losses, many highlighted the similar approach of quality standard enforcement of today’s ACO organization to those of Managed Care/HMO organizations, which had a lot of bad press for “compromised care quality for the sake of saving pennies”. The discussions around how to find a unique success path for today’s ACOs that is different from the HMOs are at white hot.

Confusion and frustration among stakeholders participating in CMS’ ACO programs and benchmarking continues to prompt thought-leaders to ponder, “What makes for an effective and successful ACO?”

Although there are many types of organizations in a wide range of regions participating in ACO programs, successful Accountable Care Organizations do have a few commonalities across the board. Commonalities successful ACOs share are:

They are usually smaller organizations.

It seems that smaller organizations, serving fewer Medicare patients (Medicare beneficiaries) are able to generate more savings. These ACOs may have a larger impact on their beneficiaries and the bottom-line for their organization than larger ACOs.

Analysis of CMS’ MSSP quality results and proposed benchmarking rules conducted by Health Affairs , the trend continued reflecting from 2012–2014 that smaller ACOs generate more savings, and only 92 of the 333 MSPs qualified for shared savings. ACOs with fewer than 6500 beneficiaries averaged 1.5 percent savings while ACOs with more than 20,000 beneficiaries averaged .5 percent savings.

This may demonstrate that although small ACOs do not report larger numbers, the team-based atmosphere within physician-based clinics may generate a more personalized patient experience resulting in better patient quality outcomes.

Dedicated to a long-term, value-based, healthcare system is interwoven in the organization’s culture.

When you don’t believe a new policy is going to stick around, you do little to learn about it or enforce it. The same goes for ACOs implementing new reimbursement structures or quality protocols.

ACOs that dedicate to stick with value-based reimbursement long-term see improved financial results with each consecutive year. However, the increased risk and investment of transitioning from fee-for-services payers to population based ones has discouraged some organizations from participating.

“It’s significant that they all demonstrated quality improvements,” Dr. Jonathan Niloff, Chief Medical Officer of McKesson asserted. “Those are much easier to achieve at the beginning than the direct financial improvements. But I think it’s interesting to see that the longer one has participated in the program, the greater the probability that one is accruing the clear financial savings.’”

Their IT is seamlessly integrated.

Technology is great when it works and a pain when it doesn’t. When a system is not synced between providers, payers, and even patients, it makes keeping track of everything extremely difficult. This also makes submitting for reimbursement under the different ACO programs time-consuming, because numbers entered into a system might have to be manually transferred between systems.

Implementing the technology among networks in adherence to the interoperability required by CMS is no easy task. In 2014, McKesson’s survey showed 23 percent of providers and 41 percent of payers had issues with systems integrations. Many healthcare organizations already have quality measures in place for patient outcomes, experiences, safety, and clinical processes.

The challenge for ACOs comes when trying to compare quality measures to financial indicators—with only 37 percent of organizations able to evaluate quality and costs. eHealth Initiative and Premier Inc. also reported that 88 percent of ACOs have difficulty with integrating technology and analytics (83 percent) into processes.

A consistent IT infrastructure among an ACO is vital to its success.

They use the same EHR among the entire network.

Having an IT infrastructure consistent among an organization is great, but it is even better if an ACO can use the same Electronic Health Record (EHR) among the network. Altruis Health attributes its ACO program success, of saving Medicare $4.5 million and gaining $2.8 million in return, to using the same EHR program among the entire Altruis system.

They are dedicated to innovative treatments.

If providers and payers don’t want to change, it is going to make being successful in CMS’ reimbursement tracks pretty tricky. CMS has the programs structured to reward providing higher quality treatment and better patient outcomes. However, changing the total scope of patients’ treatment can be financially risky.

Former Pioneer—Dartmouth-Hitchcock—cited reasons such as, “ACO model’s risk-adjustment methodology, target benchmarking, and incentive distribution were the leading factors” to leave CMS’ Pioneer ACO program. Similarly, Steward Integrated Healthcare Network was among the ACOs to drop out of Medicare’s Pioneer program.

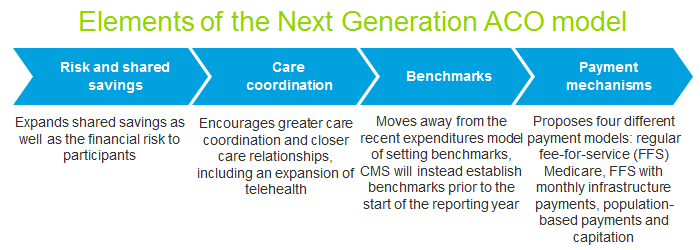

However, former Pioneer ACO’s dedication to improved patient care and financial outcomes has prompted them and other former Pioneers to prompt suggestions for future CMS programs including the upcoming New Generation Model ACO. (Steward is among the 18 participants for this 2017 ACO program.) ACO’s wanting to join the New Generation Model, must leave the last year of the Pioneer track in order to participate.

Credit: Deloitte.

The New Generation Model ACO (NGACOs) will include benefit enhancements and waivers for services like tele-health and post-discharge home visits to improve patient care. Benchmarks for the program are supposed to have a higher and continued focus on improving patient care while reducing payer costs by providing tools to do so.

This will require a greater financial risk for ACOs by increasing their investment into the program. However, CMS recognizes this risk by rewarding ACOs with a higher financial benchmark to correlate with a higher percentage of savings and reimbursement. In addition to the ACO’s larger earning potential under the new model, there is greater flexibility in payment options. The four options available for ACOs are Population Based Payments, Fee-for-Service with ACO Support, Normal Fee-for-Service, and Capitation.

Under the New Generation Model ACO, providers can better care for Medicaid beneficiaries by being able to coordinate care with non-ACO providers. There is an incentive through for NGACOs beneficiaries to receive treatment from NGACO providers.

Better benchmarks are also incorporated into the new model. CMS incorporated feedback from ACOs and Pioneer dropouts. The refinement in the formulas should encourage ACOs used to risk-based compensation to join the New Generation Model ACO program.

Conclusion

CMS has taken ACOs feedback and results each year to gradually improve value-based performance measures and reimbursement for Medicare providers and payers. Successful ACOs do have commonalities among them including a long-term vision to improve patient care, while controlling the overall care cost but not at the expense of the provider experience However, the success of an ACO organization does not necessarily have one silver bullet. Access to a solid IT network and consistent software, horizontal and vertical integration within and amongst ACOs (both physicians network and hospital network) will help improve ability for everyone in the ACO network to achieve the tricky balance of quality and costs objectives.

For further discussions around ACOs and latest trend in new healthcare delivery model, visit us at Medology360 View.